The treasure

Swimming Pool And Fully Facilitated-Club House

RERA No. : P-IND-17-742

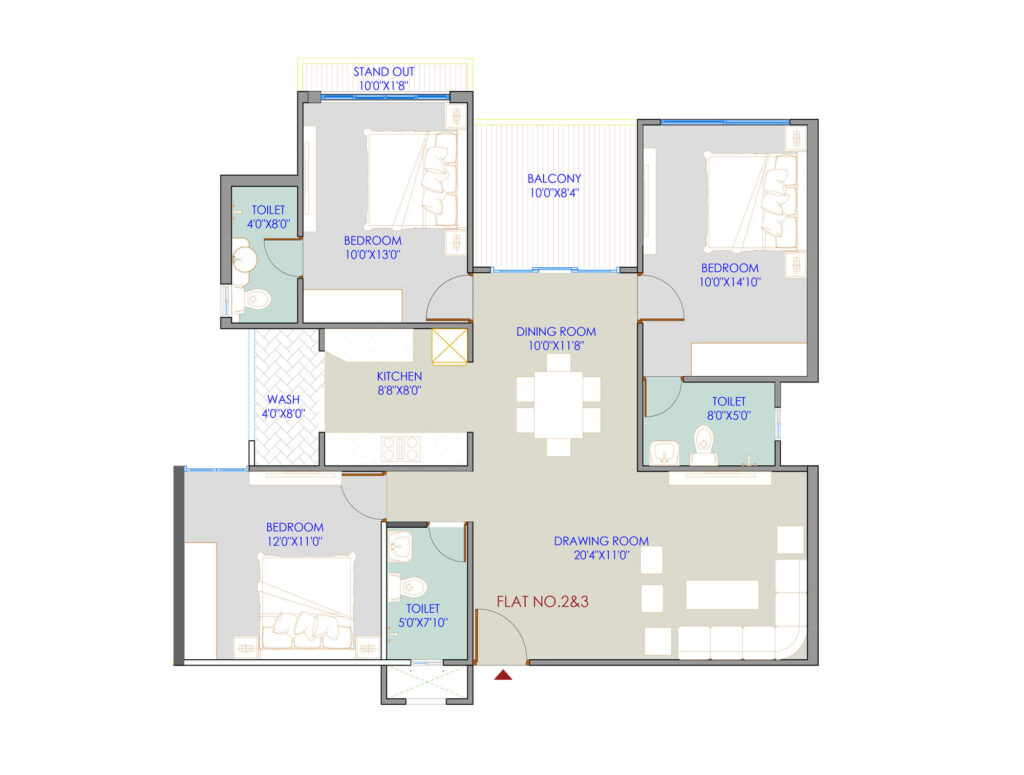

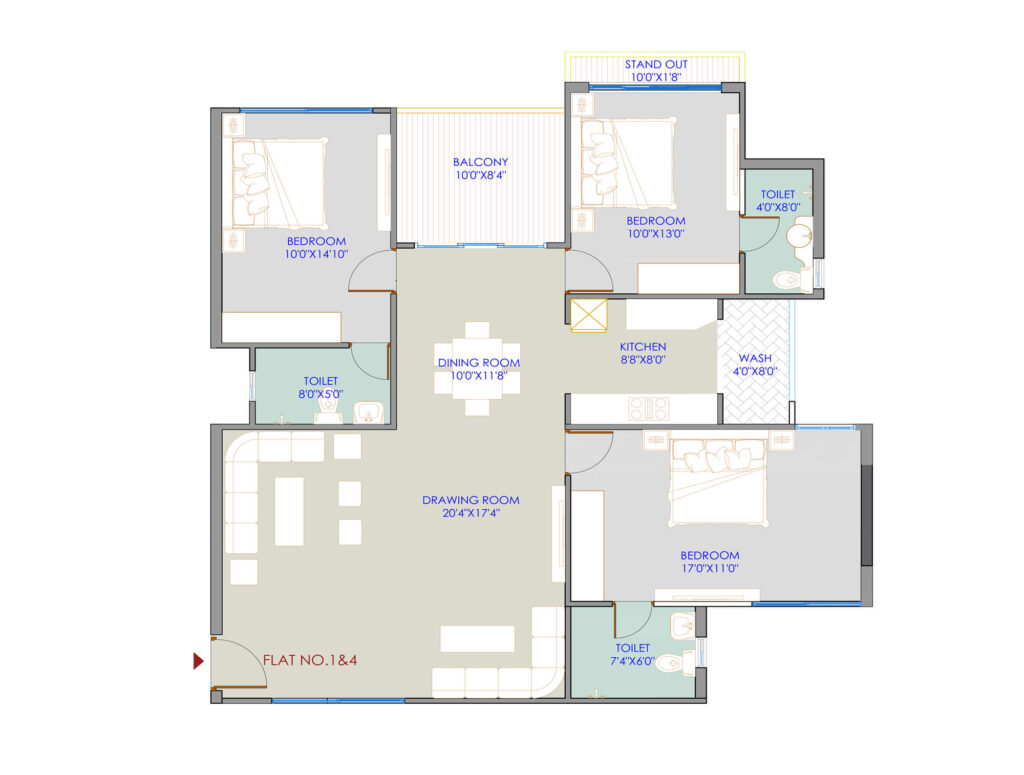

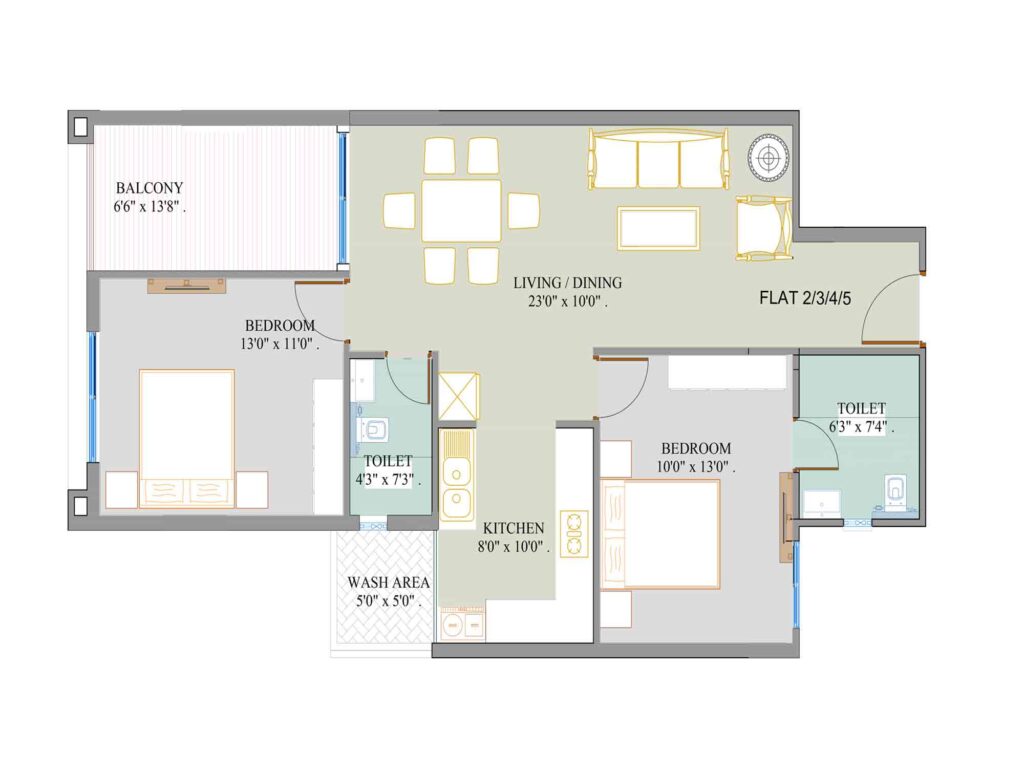

Royal Greens, as evident by its name, is home to your lavish lifestyle and opulent greenery. Open your eyes each morning to beautifully landscaped greenery with the sun shining in your home, playing hide and seek with the trees. The beauty of Royal Greens is not only in its luxuriousness but its availability in the most desired location of the city at Niranjanpur, Vijay Nagar. Royal Greens is already home to over 200 families, all of whom are happily inhabiting, enjoying a sumptuous lifestyle. The township offers 2 or 3 BHK flats each with a pleasing view of nature in all its simplistic glory.

Project Type

Flats

Total Unit

434

Area Range

1230 to 1971 Sq.ft

Location

Niranjanpur, Vijay Nagar, Indore

Price

55.35 lakhs onwards

Possession

2024

Total Towers

11

Project Area

5 Acre

AMENITIES :

That Make Living Truly Pleasurable

Over 200 Happy Families

Club House with World Class Facilities

Magnificent Temple

Convenient and Hassle Free Parking

Sprawling Spaces of Lush Greenery

uilt with Magnificent Entrance Gate

State of Art Swimming Pool

Spacious Jogging and Walking Track

Modern gymnasium Fitness club

Recreational Indoor Games

Library with well stocked books and Magazines

Fully Equipped Joyful Kids play area

SPECIFICATION :

Visually Enhance your Home Decor

Door

All Doors are Flush Doors with SS Fitting

Paint

Plastic Paint on inner Walls with Putty Finish , Weather shield Paint on Outer Walls.

Electric Fitting

Concealed Copper Wiring and M.C.Bs with Box and Modular Switches T.V. Telephone & A.C. Points Provided in Drawing Room & All Bed Rooms.

Kitchen

Granite Platform with 2 Feet Height Tiles & Steel Sink.

Flooring

In Drawing, Dining, Kitchen and all Bedrooms-Vitrified Tiles.

Windows

Powder-Coated Aluminum sliding Windows.

Toilet

All with Western Seat, Spartek Tiles on floor and colored Glazed Tiles up to Door Height, Hot & Cold water Line in Master Toilet , C.P. Fittings of jaquar or Equivalent Quality.

ENQUIRE NOW

Its easy to get overwhelmed with the unique propositions of royal greens. Let us help you in making up your mind.

ABOUT DEVELOPER

As We Strive towards Excellence, Recognition Becomes Inevitable.

Man Developments is Central India’s most prestigious company boasting of 35 years of experience in real estate. Having rightfully earned the reputation of being reliable and trustworthy, they are also known for quality construction as they aim at building a home, not a house. Their residential and commercial projects have always set them apart because of their efforts to cater to each client as per evolving needs.

MARKETED BY

Indoprop - A Name you can Trust Always

Indoprops is one of its kind, professionally driven real estate marketer in central India. We deal exclusively in Indore’s best and most trusted real estate brand Man Developments for their all the projects including Royal Greens at Niranjanpur. We at team Indoprops are committed to bringing the right home choices for you.

LOCATION MAP

LOCATION ADVANTAGE

| Proposed Railway Station | 3 Km |

|---|---|

| Hospital | 2 Km |

| Malls | 4 Km |

| Metro (Whole Sale Market) | 2 Km |

| Airport | 15 Km |

| Bank | 1 Km |

| School/Colleges | 2 Km |

|---|---|

| Multiplex | 4 Km |

| Brilliant Convention Center | 3 Km |

| Hotels | 3 Km |

| Supper Corridor (IT Hub) | 7 Km |

| Vijay Nagar | 4 Km |